Driving is an exciting milestone, but it comes with its own set of responsibilities and risks. For new drivers, making the right insurance choice is crucial for safeguarding their vehicle and financial future. Comprehensive auto insurance is an excellent option that offers extensive protection against a variety of unexpected events. In this article, we’ll explore the key benefits of comprehensive auto insurance, address common misconceptions, compare it with other types of coverage, and share real-life examples to illustrate its value.

Toc

- 1. Introduction of Comprehensive Auto Insurance

- 2. Common Misconceptions About Comprehensive Auto Insurance

- 3. Comparing Comprehensive Auto Insurance with Other Types of Coverage

- 4. Choosing the Right Comprehensive Auto Insurance

- 5. Real-Life Examples of Comprehensive Auto Insurance in Action

- 6. Conclusion

Introduction of Comprehensive Auto Insurance

When it comes to auto insurance, there are several types of coverage available. Liability insurance is required by law and covers damages caused to others in an accident. Collision insurance helps cover the cost of repairing or replacing your vehicle if you are at fault in an accident. However, comprehensive auto insurance goes above and beyond these basic options.

What is Comprehensive Auto Insurance?

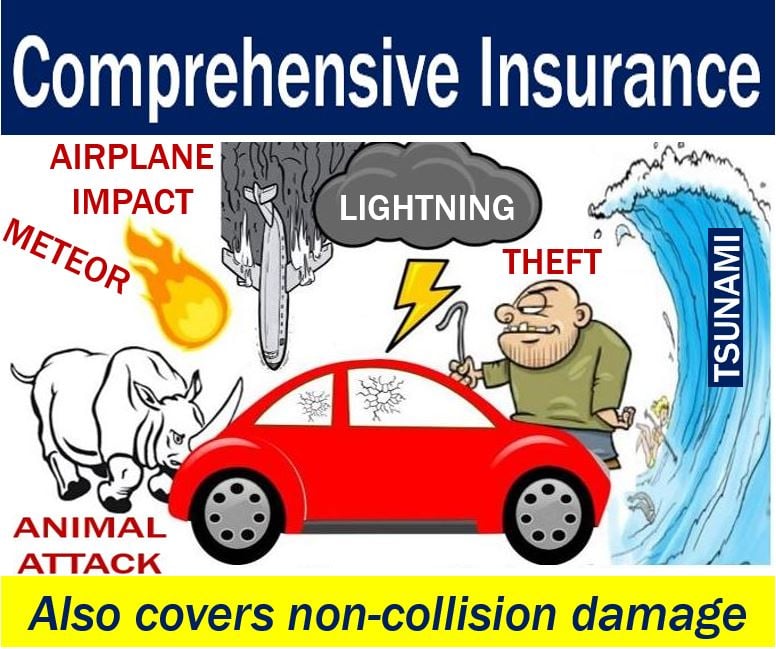

Comprehensive auto insurance covers non-collision-related incidents that could damage your vehicle. This includes protection against theft, vandalism, natural disasters, and other unforeseen events. While it doesn’t cover collisions with other vehicles or objects (that’s where collision insurance comes in), it provides a broad safety net that many new drivers find invaluable.

Key Benefits of Comprehensive Auto Insurance

- Protection against theft: Car theft is a real concern for many drivers, especially in urban areas. Comprehensive insurance helps cover the cost of replacing your car if it’s stolen or damaged during an attempted theft.

- Coverage for natural disasters: From hurricanes to wildfires, Mother Nature can be unpredictable and destructive. If your vehicle is damaged by a natural disaster, comprehensive insurance can help cover the costs of repairs or replacement.

- Peace of mind: With comprehensive auto insurance, you can rest easy knowing that your vehicle is protected from a wide range of potential risks. This can give new drivers peace of mind as they navigate the roads.

Common Misconceptions About Comprehensive Auto Insurance

Despite its benefits, there are some misconceptions about comprehensive auto insurance that may make new drivers hesitant to choose it.

Misconception 1: It Covers Everything

While comprehensive auto insurance does offer extensive coverage, it is essential to understand that it does not cover every possible scenario. For instance, as previously mentioned, it does not include damages resulting from collisions with other vehicles or objects. This type of coverage falls under collision insurance. Additionally, comprehensive insurance does not cover personal belongings inside the vehicle; for that, you might need a separate personal property insurance policy. By understanding what comprehensive insurance does and does not cover, drivers can make informed decisions and avoid unpleasant surprises when filing a claim.

Misconception 2: It Is Unaffordable for New Drivers

A common belief is that comprehensive auto insurance is prohibitively expensive, especially for new drivers who may already be facing high premiums. However, this isn’t always the case. Many insurance providers offer a range of plans and discounts that can make comprehensive coverage more affordable. Factors such as a good driving record, the type of vehicle, and even bundling policies with the same insurer can significantly reduce costs. It’s always advisable to shop around, compare quotes, and perhaps consult with an insurance broker to find a policy that fits your budget without compromising on coverage.

Misconception 3: Only Necessary for High-Value Cars

Another misconception is that comprehensive insurance is only necessary for high-value or new cars. In reality, any vehicle can benefit from the protection it offers. An older car, for instance, might be more susceptible to weather damage or theft due to lack of modern security features. Comprehensive coverage ensures that, irrespective of your vehicle’s age or market value, you have a safety net for a broad array of potential damages.

Comparing Comprehensive Auto Insurance with Other Types of Coverage

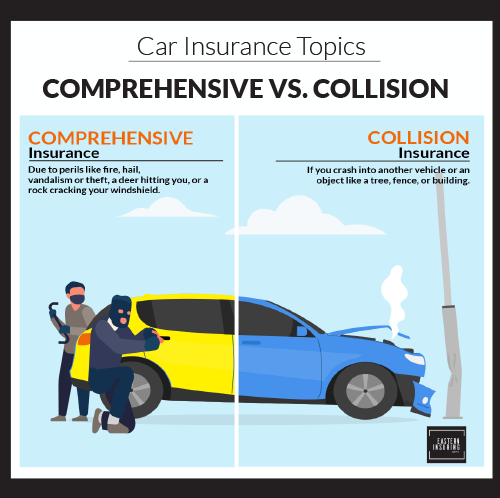

To better understand the value of comprehensive auto insurance, it’s helpful to compare it with other types of auto coverage. While liability and collision insurance focus on accidents and legal obligations, comprehensive insurance offers an added layer of security against non-accident-related damages. Each type of insurance serves a unique purpose, and together, they provide well-rounded protection for drivers. In the following sections, we will delve deeper into these comparisons and provide real-life scenarios to highlight the practical benefits of comprehensive auto insurance.

Comparing Comprehensive Auto Insurance with Other Types of Coverage

Comprehensive vs. Liability Insurance

As mentioned earlier, liability insurance is a legal requirement in most states. It covers damages to others if you are at fault in an accident. However, it does not cover damage to your vehicle or personal property inside it. In contrast, comprehensive insurance offers broader protection against a wider range of risks.

Example Scenario:

You get into an accident that is deemed your fault while driving on the highway. Your liability insurance will cover the costs of repairing the other driver’s car and any medical expenses they may have incurred. However, if your vehicle sustains any damage, you would have to pay for those repairs out of pocket unless you have comprehensive coverage.

Comprehensive vs. Collision Insurance

Collision insurance, as the name suggests, covers the costs of damage to your vehicle resulting from collisions with other vehicles or objects. However, it doesn’t cover non-collision-related incidents such as theft or natural disasters. Comprehensive insurance offers a more comprehensive level of protection by combining collision and non-collision coverage.

Example Scenario:

A tree falls on your car during a storm, causing significant damage. If you only have collision insurance, you would be responsible for paying for the repairs. However, if you have comprehensive insurance, your policy would cover the costs of repairing or replacing your vehicle.

Choosing the Right Comprehensive Auto Insurance

Choosing the right comprehensive auto insurance can be a daunting task, but by understanding your personal needs and the specifics of various policies, you can make an informed decision. Start by evaluating the coverage limits and deductibles of potential plans. A higher deductible often results in lower premiums but means more out-of-pocket expenses in the event of a claim. Make sure to strike a balance that aligns with your financial situation.

Tips to Choosing the Right Comprehensive Auto Insurance

- Assess Your Vehicle’s Value: Begin by considering the value of your car. High-value or newer vehicles will likely benefit more from comprehensive coverage due to the greater potential cost of repair or replacement. However, even older cars can benefit from this insurance, especially if they are susceptible to certain risks like theft or natural events.

- Compare Policies: Don’t settle for the first quote you receive. Compare multiple policies from different insurers to understand the range of coverage and costs available. Pay close attention to what each policy includes and exclude to ensure you’re getting the protection you need.

- Check for Discounts: Many insurance companies offer discounts that can significantly reduce your premiums. These might include safe driver discounts, multi-policy discounts, or discounts for installing safety features in your vehicle. Always ask about potential savings when discussing your policy options with an insurer.

- Evaluate Coverage Limits and Deductibles: Understanding the coverage limits and deductibles of a policy is crucial. Higher coverage limits offer more protection but usually come with higher premiums. Conversely, higher deductibles lower your premium cost but increase your out-of-pocket expenses in the event of a claim. Find a balance that suits your financial situation and risk tolerance.

- Review the Claims Process: A streamlined claims process can make a big difference when you need to file a claim. Look for insurers with strong customer service reputations and straightforward claims procedures. Reading customer reviews and ratings can provide insights into the experiences of other policyholders.

- Consider Add-Ons: Some insurers offer additional coverage options that can be bundled with comprehensive insurance. These might include rental car reimbursement, roadside assistance, or gap insurance. Assess whether these add-ons align with your needs and can provide additional peace of mind.

By considering these tips, you can better navigate the options available and select a comprehensive auto insurance policy that provides the right level of protection for your specific circumstances. Remember, the key is to understand your needs and how various coverage options can address them effectively.

Top Best Comprehensive Auto Insurance Providers in US 2024

When selecting comprehensive auto insurance, it’s helpful to know which providers are highly rated for various factors such as coverage options, customer service, affordability, and claims process efficiency. Here are some top providers to consider:

- Geico: Geico is known for its affordable rates and extensive discounts, making it a popular choice among drivers. The company also boasts a user-friendly mobile app and website, which simplifies managing your policy and filing claims. Geico’s comprehensive coverage options can be tailored to meet individual needs, providing peace of mind for policyholders.

- State Farm: State Farm is highly regarded for its excellent customer service and robust network of agents. With a wide range of coverage options, including various add-ons, it is adaptable to different insurance needs. State Farm also offers significant discounts, such as those for safe driving and multiple policies, which can help lower premiums.

- Progressive: Progressive provides innovative tools such as the Name Your Price tool, which allows customers to find coverage that fits their budget. Known for competitive rates and extensive coverage options, Progressive also offers attractive discounts like multi-car and continuous insurance discounts. Its efficient claims process and solid customer service make it a go-to choice for many drivers.

- Allstate: Allstate stands out with its comprehensive coverage options and numerous add-ons, including accident forgiveness and new car replacement. The company’s customer service is highly rated, and various discounts are available to help reduce premiums. Allstate’s Drivewise program also rewards safe driving habits with potential savings.

- USAA: USAA is specifically available to military members, veterans, and their families and is renowned for its exceptional customer satisfaction and strong financial stability. USAA offers competitive rates, extensive coverage options, and valuable discounts tailored to the unique needs of military families. The insurer’s efficient claims process and high level of customer service further enhance its reputation.

- Liberty Mutual: Liberty Mutual offers customizable comprehensive coverage plans and several optional add-ons such as accident forgiveness and new car replacement. The company’s comprehensive policies can be adapted to fit various requirements, and a range of discounts, including those for safe driving and using hybrid vehicles, can significantly lower premiums. Their claims satisfaction guarantee is an added bonus for policyholders.

Real-Life Examples of Comprehensive Auto Insurance in Action

To better understand the value of comprehensive auto insurance, let’s look at some real-life examples where it has proven beneficial:

Sarah’s Hailstorm Damage

During a particularly intense hailstorm, Sarah’s car was parked outside and ended up severely damaged by the large hailstones. The hood, roof, and windows suffered extensive damage, leaving her vehicle inoperable. Fortunately, Sarah had a comprehensive auto insurance policy. After assessing the damage, her insurance provider covered the cost of repairs, saving her thousands of dollars and allowing her to get back on the road quickly.

Mark’s Car Theft

Mark had just moved to a new city and was still familiarizing himself with the neighborhood. One morning, he discovered that his car was missing from its parking spot. After confirming it had been stolen, Mark immediately reported the theft to the police and contacted his insurance provider. Thanks to his comprehensive auto insurance, Mark was reimbursed for the current market value of his car, minus the deductible. This financial support was crucial in helping him quickly secure a replacement vehicle.

Lisa’s Animal Collision

One evening, while driving home from work on a rural road, Lisa encountered a deer that suddenly jumped in front of her car. Despite her best efforts to avoid it, a collision was unavoidable, resulting in significant front-end damage to her vehicle. Without comprehensive insurance, the repair costs would have been a significant burden. However, her comprehensive auto insurance policy covered the repair expenses, ensuring Lisa’s vehicle was promptly restored to its pre-accident condition.

Conclusion

Choosing the right auto insurance is a critical decision for new drivers. Comprehensive auto insurance offers extensive protection against a variety of non-collision-related incidents, providing peace of mind and financial security. Don’t fall for common misconceptions—comprehensive insurance can be affordable and beneficial for any car owner.

Ready to take the next step? Learn more about comprehensive auto insurance and find the perfect plan for your needs. Remember, the right coverage today can save you from headaches tomorrow.